The global ad markets spend in 2014 will grow by $5.3 billion and reach $532 billion in total spending, according to figures from Publicis-owned ad agency ZenithOptimedia. The US will stay the largest contributor of new ad dollars with $23 billion in new spending; however the biggest relative ad markets growth will be China ($14 billion), followed by Argentina ($6 billion) and Indonesia ($5.9 billion).

The global ad markets spend in 2014 will grow by $5.3 billion and reach $532 billion in total spending, according to figures from Publicis-owned ad agency ZenithOptimedia. The US will stay the largest contributor of new ad dollars with $23 billion in new spending; however the biggest relative ad markets growth will be China ($14 billion), followed by Argentina ($6 billion) and Indonesia ($5.9 billion).

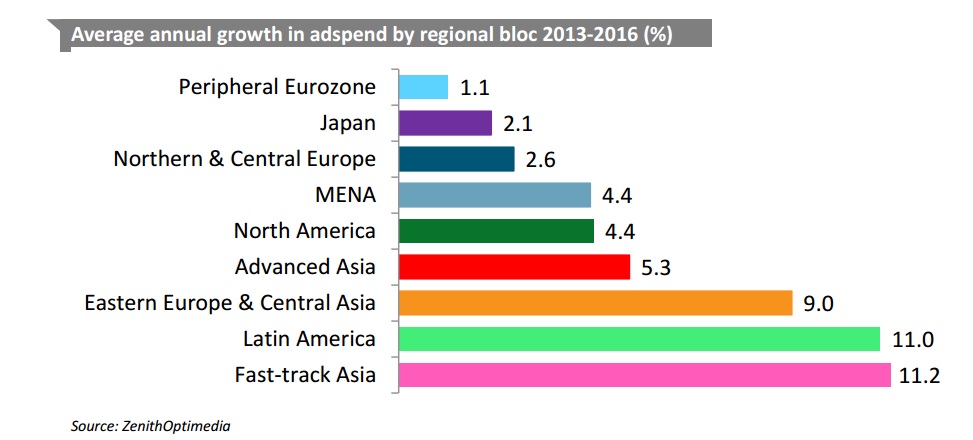

With the global ad markets forecasts continuing to predict the market grow by 5.8% in 2015 followed by another year of 5.8% growth in 2016, analysts believe that emerging markets will grow as Europe struggles to recover gradually from its recent crisis.

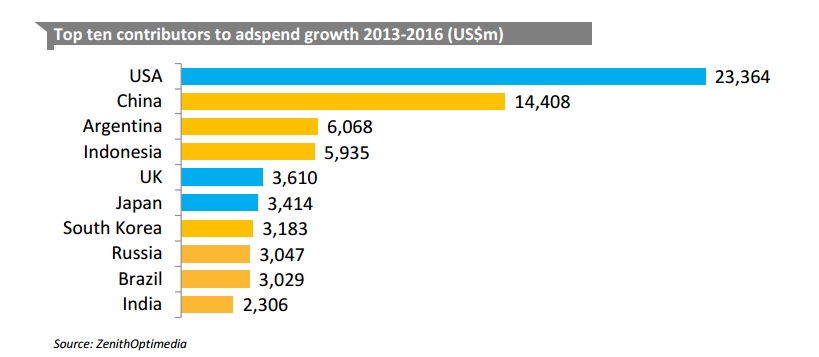

Top 10 Global Ad Markets

Seven of the ten largest contributors will be rising markets, contributing 42% of new ad spend over the next three years. Overall, we forecast rising markets to contribute 61% of additional ad expenditure between 2013 and 2016, and to increase their share of the global market from 35% to 39%.

Despite the rapid growth of the rising markets, the US is still the biggest contributor of new ad dollars to the global market. Between 2013 and 2016 it is expected the US to contribute 26% of the $90 billion that will be added to global ad spend. After the US, however, the biggest contributors are much younger and more dynamic. China comes second, accounting for 16% of additional ad dollars over this period, followed by Argentina and Indonesia, accounting for 7% each.

Ad Markets Growth Analysis

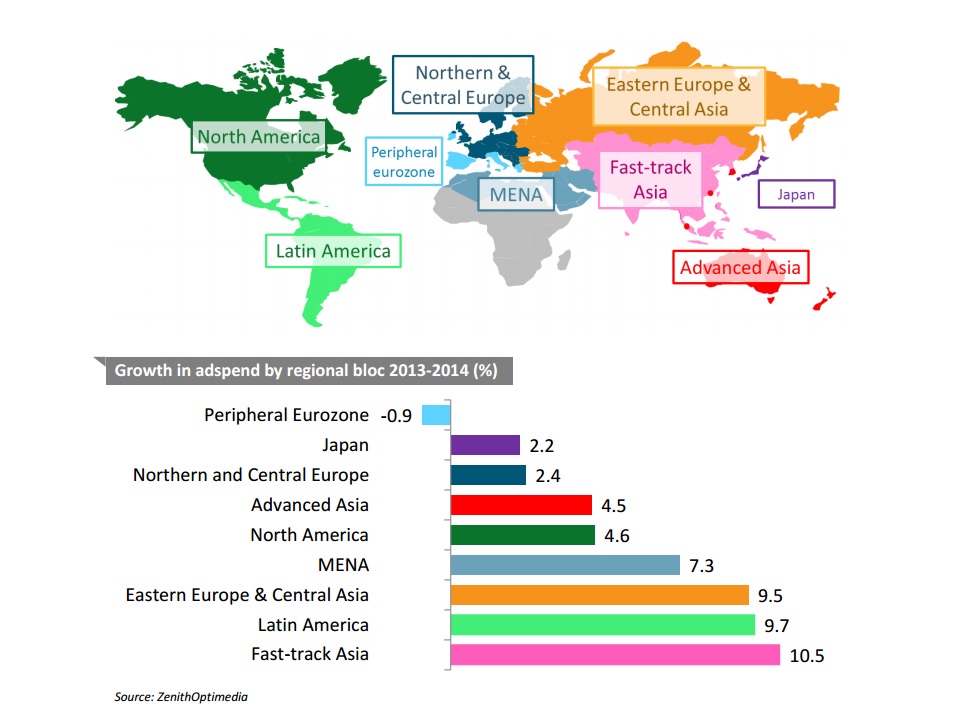

Peripheral Eurozone

In Europe, the ‘PIIGS’ markets (Portugal, Ireland, Italy, Greece and Spain), which have faced the full brunt of the Eurozone crisis, have seen their ad markets fallen even more sharply than their economies. According to recent figures, overall ad spend fell in 2013 by 11.1% with 2014 looking a lot better with forecasts to shrink by just 0.9%, followed by a slow recovery of 1.8% growth in 2015 and 2.5% growth in 2016.

Eastern Europe & Central Asia

Eastern European advertising markets, such as Russia and Ukraine, generally recovered quickly after the 2009 downturn and have since continued their healthy pace of growth. Their near neighbors in such as Azerbaijan and Kazakhstan, have behaved very similarly. It is expected this bloc to have grown 11.7% in 2013, followed by an expected 8%-10% growth in the next two years.

Fast-track Asia

Historically considered the “developing markets” of Asia, China, India, Indonesia, Malaysia, Pakistan, Philippines, Taiwan, Thailand and Vietnam have become the fastest growing markets in the word. Fast-track Asia barely noticed the 2009 downturn (ad expenditure grew by 7.2% that year) and since then has grown comfortably at double-digit rates each year. Estimates show that ad expenditure in these countries grew by 10.7% in 2013, followed by an estimated 10% to 12% annual growth in 2014 to 2016.

North + Latin America

Ad spend in North America grew by 3.3% in 2013, and is forecasted to stay strong with 4.6% growth in 2014, followed by another year of 4.6% growth in 2015 and 4.1% growth in 2016.

Latin America on other hand is a region with rapidly growing economic output, and its ad market is growing at a similar rate. After an estimated 8.0% growth this year, it is forecasted annual growth of between 10% and 13% over the next three years.

Middle East & North Africa

After the overall uncertainty following the Arab Spring in December 2010 brought ad spending to shrink by 14.9% in 2011, markets started to recover in 2013 with a 4.7% growth in ad expenditure. This trend is believed to continue with an estimated 7.3% growth in 2014, though expected to slow down a bit with 3% annual growth in 2015 and 2016

Want to stay up to date with everything new in the digital marketing world? Be sure to follow Infolinks on Facebook and Twitter, and also visit our blog for all the latest!