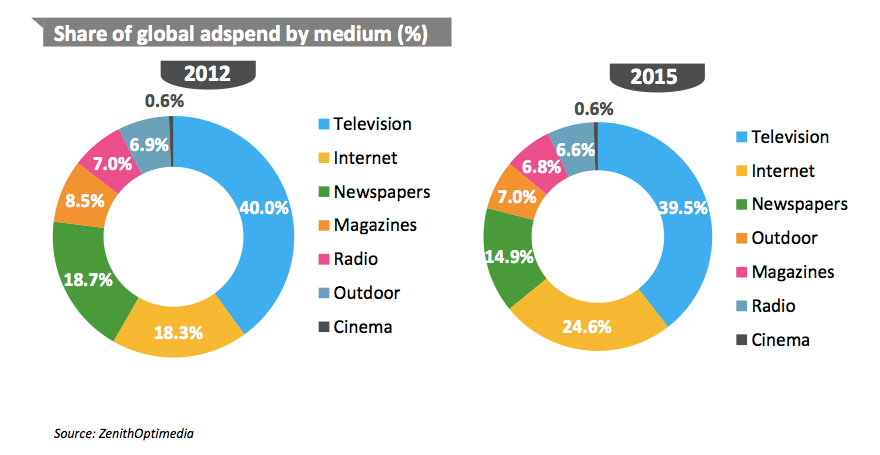

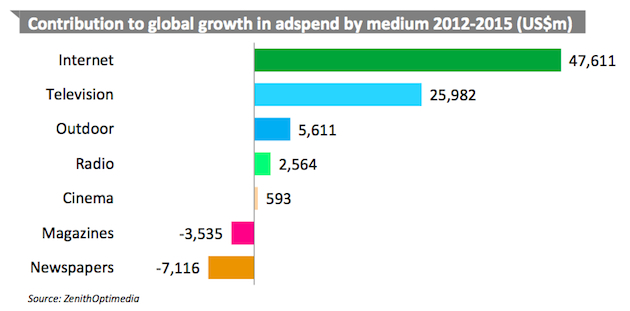

The good news is that Internet advertising spend is growing faster than any other medium. The bad news is it still remains a small player with less than 50% of the total market value of TV ad spend. Traditional media formats like television, newspapers, magazines and radio still attract most advertising dollars, though they note that they are measuring online advertising in a smaller subset of companies.

The good news is that Internet advertising spend is growing faster than any other medium. The bad news is it still remains a small player with less than 50% of the total market value of TV ad spend. Traditional media formats like television, newspapers, magazines and radio still attract most advertising dollars, though they note that they are measuring online advertising in a smaller subset of companies.

According to a recent Advertising Expenditure Forecast from ZenithOptimedia, digital advertising accounted for 21.8% of all ad spend in 2013 ($109.7 billion), up from 19% the year before. Meanwhile, mobile remains a solid minority of activity with only 3.7% of all ad spend in the U.S. ($6.2 billion). Excluding television, traditional media budgets took hits in 2013, as spending in cinema, magazines and radio all declined (-1.3%, -1.1% and -0.7%). Ad spend in newspapers declined the most, dropping 2.2%.

Banners Are Just Not Enough Anymore

When looking at the rise of display advertising, is it is clear that the focus will continue to shift from standard display ad units to more dynamic, engaging ad units. Banners won’t cut it anymore, and brands will look to native advertising and richer content ads to draw in consumers as larger percentages of big scale advertising budgets are being spent on display and search.

Companies like motor giant Ford that started pushing it’s more than 3,200 dealers across the U.S. towards paid search. The goal: introduce Ford dealers to paid search if they aren’t using it and bolster the budget of those who are. In addition to the direct subsidy for paid search, Ford is requiring dealers to put more of their advertising co-op toward digital advertising, such as paid search and banner ads.

Ford joins Chrysler Group, Scion and others that have launched or changed co-op programs recently to increase dealers’ digital advertising and capitalize on changing shopping patterns. Nine of 10 shoppers do at least some vehicle research online, studies show. And two of three visitors to a dealer Web site get there via a Google link.

The Main Driver of Online Ad Spend: Mobile

Mobile is now the main driver of global adspend growth. Mobile is forecasted that to contribute 36% of the entire extra ad spend between 2013 and 2016. Television is the second largest contributor (accounting for 34% of new ad expenditure), followed by desktop internet (25%), which continues to enjoy significant growth alongside that of mobile advertising.

The figures are no less impressive outside the U.S. market. On a global basis, mobile advertising was worth $8.3bn in 2012, or 9.5% of internet expenditure / 1.7% of advertising across all media. “By 2015 we forecast this total to rise to $33.1 billion, which will be 25.2% of internet expenditure and 6.0% of all expenditure.

Major players like Facebook and Apple have launched new products trying to capitalize on video content (classic television advertising format) and the rise of mobile. Facebook launched its first video ads, that will be 15-20 seconds long and will auto play in mute mode on all of our news feeds in the upcoming months. Apple is also rumored to be launching new “iAds that look a lot like TV ads”. These ads will automatically play full-screen within iPhone and iPad apps and interrupt whatever someone is doing in app. A major player in mobile hardware and software, Apple remains a relatively newcomer to the mobile ad business.

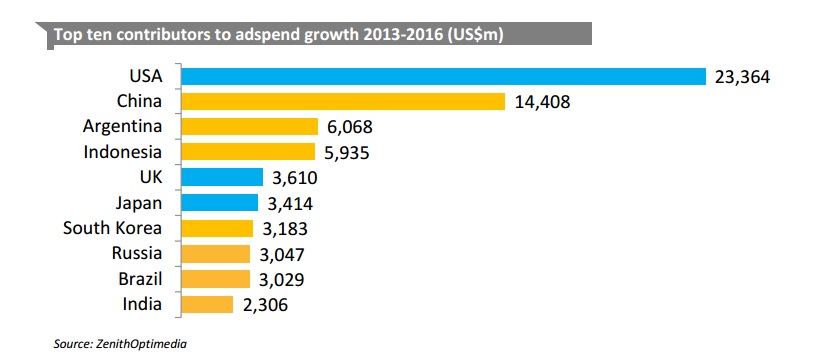

The Main Markets of Ad Spend Growth: Latin America and Asia

According to recent reports from ZenithOptima, global ad markets spend in 2014 will grow by $5.3 billion and reach $532 billion in total spending. The US will stay the largest contributor of new ad dollars with $23 billion in new spending; however the biggest relative ad markets growth will be China ($14 billion), followed by Argentina ($6 billion) and Indonesia ($5.9 billion).

Seven of the ten largest contributors will be rising markets, contributing 42% of new ad spend over the next three years. Overall, we forecast rising markets to contribute 61% of additional ad expenditure between 2013 and 2016, and to increase their share of the global market from 35% to 39%.

Want to stay up to date with everything new in the digital marketing world? Be sure to follow Infolinks on Facebook and Twitter, and also visit our blog for all the latest!